Navigating the 2024 GTA Real Estate Market: Insights from Royal LePage’s Market Forecast

In this blog post, I will delve into the key statistics and data driving Royal LePage's market forecast for 2024, providing insights into the factors influencing the real estate landscape in Oakville, Burlington, and Mississauga and the rest of the GTA. Stay tuned until the end to discover Royal LePage's predictions for the National Aggregate home price by the close of 2024.

Market Overview: Reflecting on 2023 and Anticipating 2024

Building upon the turbulent yet resilient real estate market of 2023, the focus in 2024 revolves around interest rates. Industry experts anticipate a key rate drop by the Bank of Canada, potentially easing pent-up demand and shaping the course of the market.

Key Variables Shaping the Market:

1. Population Growth: Canada experienced unprecedented population growth, with a staggering 1 million people added in 2023. When considering the additional 2.5 million non-permanent residents, the demand for housing in Oakville, Burlington, and Mississauga and the rest of the GTA becomes a critical factor in the market equation.

Canada’s population grew at an unprecedented rate in 2023.

2. Increase in Household Net Savings: Household net savings saw a noteworthy increase in Q3 of the previous year, with a 1% gain in disposable income surpassing a rise in spending by 0.8%. This financial stability indicates a potential influx of homebuyers with savings for down payments.

Household net savings increased in Q3 of 2023.

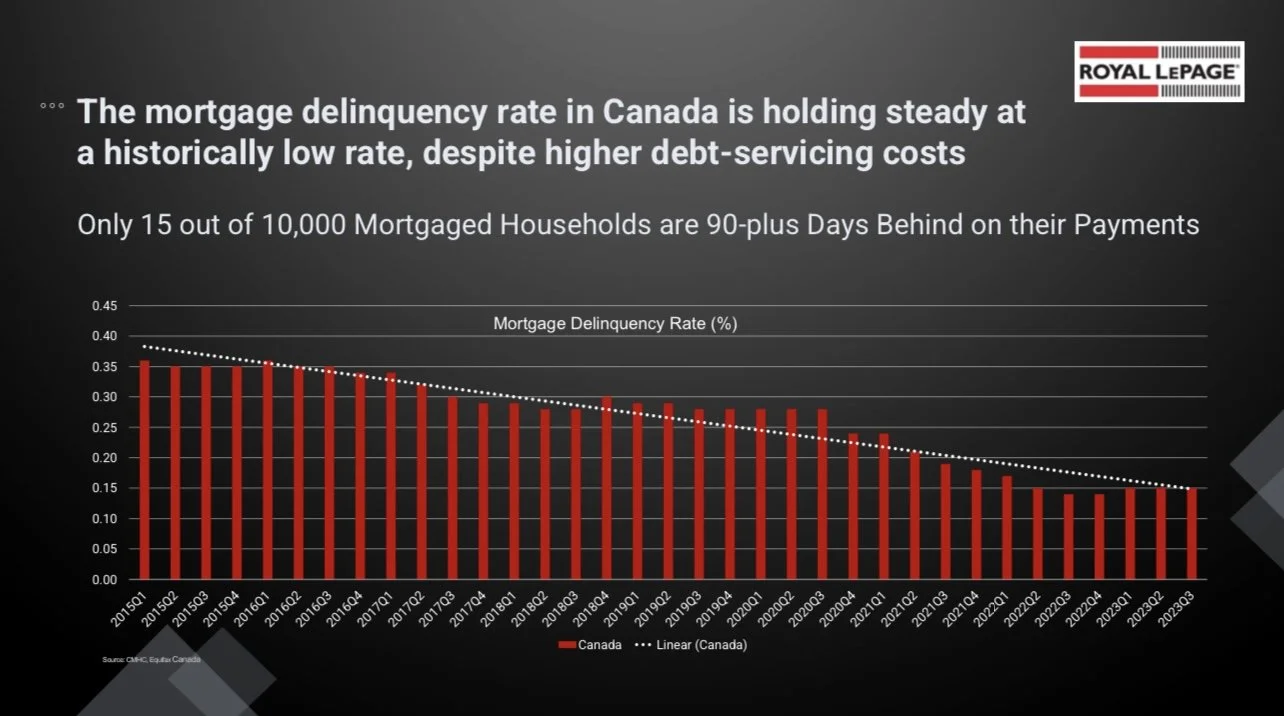

3. Low Mortgage Delinquency Rate: Despite higher debt-servicing costs, Canada maintains a historically low mortgage delinquency rate. A mere 15 out of 10,000 mortgaged households are 90+ days behind on payments, highlighting the resilience of the real estate sector.

Mortgage delinquency is holding steady at a historically low rate.

4. Low Housing Starts: Housing starts fall short of meeting the demographic demand, as outlined in a recent CMHC article. In November 2023, the standalone monthly Seasonally Adjusted Annual Rate (SAAR) of total housing starts in Canada decreased by 22% from October. In key areas like Toronto and Vancouver, total SAAR housing starts dropped by 39%.

Housing starts are not keeping up with high demand for housing.

5. Anticipated Interest Rate Cuts: Sources such as RBC Economics and TD Economics predict modest interest rate cuts in 2024, expected to stimulate real estate activity in Oakville, Burlington, Mississauga.

Modest interest rate cuts in 2024 are expected to spur activity.

Royal LePage's Forecast: Considering the multifaceted variables at play, Royal LePage forecasts a 5.5% increase in the National Aggregate home price by the end of Q4 2024.

Engage with Me: Your Thoughts Matter!

Now, I want to hear from you. Do you believe this forecast aligns with your expectations for the real estate market in Oakville, Burlington, and Mississauga in 2024? Share your thoughts in the comments or send me a message – I value your insights.

As we navigate the intricate landscape of the 2024 real estate market, armed with data and predictions, I remain committed to providing you with the latest insights. Thank you for reading, and if you have any questions or thoughts, please feel free to reach out – your perspective is crucial in shaping our ongoing conversation about the real estate landscape in Oakville, Burlington, Mississauga and the GTA.